Eclecticsite.com Welcomes You To...

| Home | Articles | Links | Books | Software | Favorite Financial Bible Verses |

| Note: The information given on this site is accurate and correct to the best of my knowledge. Please know that all of the thoughts, information, suggestions and techniques given on this site are nothing more than the author's opinion on the matter being addressed. Do further research before making any decisions. If you need counseling on matters not related to finances (such as relationships, emotions, personal crisis, marriage, family, etc.) please call 1-800-NEW-LIFE. |

Are you on

the edge of

financial disaster? Take these two,

quick tests and find out...

Are you on

the edge of

financial disaster? Take these two,

quick tests and find out... Now

for the good news...

Now

for the good news... Financial Articles currently

available:

Financial Articles currently

available:

| I have some great eBooks available! Click HERE for more information. |

Want to reduce financial stress, eliminate debt and get ahead financially? Get started by reading these numbered articles in order. (Note: These articles represent nothing more than the author's opinion on the topic being discussed) |

|

#1 The Secret to Becoming Wealthy What you need to know to eliminate financial stress and eventually become wealthy. #2 You Need a Plan Why you need a budget, and how to create one. #3 You Need Savings Why you need savings and how much you need. |

#4 Eliminating Debt...Completely! The wonderful feeling of being debt free, and how to get there. #5 Financial Checklist A quick checklist of what you need to do and in what order. |

Additional Articles Dealing With A Variety Of Financial Topics. These additional articles are in no particular order. (Note: These articles represent nothing more than the author's opinion on the topic being discussed) |

|

| My Humble Opinion What's on my mind regarding finances. The Secret Federal Law That Lets Anyone Walk Away From Debt Without Paying It Looking for a quick, easy solution to debt problems? Signs of Financial Disaster How to know if you are you headed for a financial disaster. To Whom You Should Listen From whom to take your advice, and from whom not to. Before you listen to anyone's advice about money, read this! How To Choose Someone To Help You. How to choose the right financial planner, adviser or counselor. Preparing For Financial Counseling How to get ready to meet with a financial counselor. What Can You Really Afford? How much house and how much car can you really afford? When Is It Time To Buy A House? How to know if you're ready to buy a house. What Kind of Mortgage to Get Getting ready to buy a house? Then read this. Should You Pay Cash for a House? Is it smarter to pay cash, or to mortgage? How To Never Have a Car Payment Again New, used, buy, lease? Here are the answers. What About Consolidation Loans? Will a consolidation loan help you deal with debt? Is Education Important? Does having an education really matter that much? How To Be Successful In Any Job. Whether you're flipping burgers or running a company, this is good advice. Do You Have a Big But? A big but always gets in your way! Is It All Right To Have Nice Things? or Why I Have An Expensive Briefcase. How To Correct Errors On Your Credit Report From the Federal Trade Commission Why Is It So Wrong To Use Credit Cards? Why credit cards are bad. Where To Get Extra Money To Pay Off Debt A few ideas of how to bring in extra money. The Turkey Trap A story with a message. Investing In The Stock Market How to do it, and how NOT to do it. The Ten Commandments of Real Estate Investing Don't even think about investing in real estate before reading this. How To Do A Spending Journal What it is, how to do it, and how it helps you financially. Christian, Financial Counseling Page A Christian perspective on handling money God's way. Helped by this website? Please read this if you have been helped by this website. |

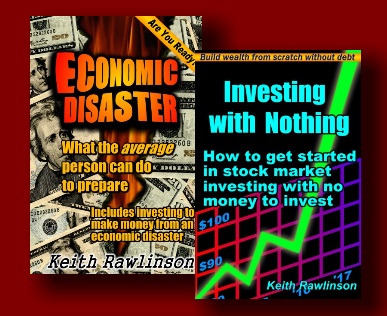

Toys-R-Us gift cards...Don't Do It! A story and a warning. Playing The Lottery If you buy lottery tickets, you better read this. Payday Loan / Cash Advance Places Is it all right to get a little help from time to time? Should I Cosign...Are You Kidding? Is a friend, family member or co-worker asking you to cosign? Do You Think Like a Wealthy Person? How the wealthy think differently than most of us. How To Know When You're Wealthy Here's how to calculate whether or not you are wealthy. Should You Rely On Credit Cards For Emergencies? Is it all right to have a credit card just in case? The Three Things That Most Commonly Get In Your Way These are the things that keep you from reaching your goals. My Teenager Refuses To Go To College What to do with a teen who does not want to go to college. Where To Get Money For College The best ways to pay for a college education. How Much Money Would You Have? What if you invested your debt payments? How much money would you have? The True Cost Of Cigarette Smoking You know that smoking damages your health, but what affect does it really have on your finances? Some Stupid Financial Advice Common stupid advice I've actually heard people give. What Kinds Of Insurance You Do And Don't Need. What kinds of insurance to buy and how much you need. Don't Buy Just Because It's A Good Deal. A good deal doesn't mean its a good idea. Are You Ready to Start Your Own Business? If you are starting, or thinking of starting, your own business, PLEASE read this! Secrets To Running A Successful Business If you have or want your own business, here's how to help it succeed. The 100 Year Light Bulb Company Would you buy a light bulb that lasts 100 years? The Marshmallow Test Here's how marshmallows can predict your financial future. Man to Man Honest talk, from one man to another, about what makes a real man. Getting Started in Investing How to invest, how not to invest, and what to invest in. Planning a funeral. Financial considerations when planning a funeral for yourself or a loved one. Investing With Nothing How to get started investing in the stock market when you don't have any money to invest. Current eBooks by Keith Rawlinson. |

| General Articles and Information |

Keith's Introduction Who I am and why I think it's all right for me to be giving you financial advice. My Humble Opinion A journal of my finance-related thoughts and opinions on current events and conditions. Statistics and Tidbits Financial statistics and tidbits I've learned over the years. The Major Consumer Credit Laws Six major consumer credit laws dealing with debt collection, credit reporting, borrowing, etc. Favorite Financial Bible Verses Ancient wisdom about handling your money. My Favorite Quotes A collection of real gems of wisdom. You can just about live by these! Sample Letters Sample letters for dealing with debt collectors and credit card companies. |

| If you have been

significantly helped by the things you have found on Eclecticsite.com's Financial Page, please click here. |

| Loan

Calculator This is a handy little utility that allows you to quickly do simple loan calculations. You fill in the information you know, and it will calculate the one you leave blank. It not only calculates your payment, but can also figure out amount borrowed, interest rate or time to repay. Future Value Calculator This is the utility I use most often. It allows you to figure out how much your investments will grow over time. You enter a starting value, monthly contribution, interest rate, and time, then calculate how much money you'll have in the future. |